Your High water mark hedge fund images are ready in this website. High water mark hedge fund are a topic that is being searched for and liked by netizens today. You can Download the High water mark hedge fund files here. Find and Download all royalty-free images.

If you’re searching for high water mark hedge fund pictures information related to the high water mark hedge fund interest, you have visit the right blog. Our website always gives you hints for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

High Water Mark Hedge Fund. Pol von der Fakult at fur Wirtschaftswissenschaften des Karlsruher Instituts fur Technologie genehmigte DISSERTATION von Dipl-Math. At this point the high-water mark for this particular investor is 575000 and the investor is obligated to pay 15000 to the portfolio manager. We provide a closed-form solution to the cost of the high-water mark contract under certain conditions. High watermark is the highest value of the fund in a financial year.

High Water Mark Definition From investopedia.com

High Water Mark Definition From investopedia.com

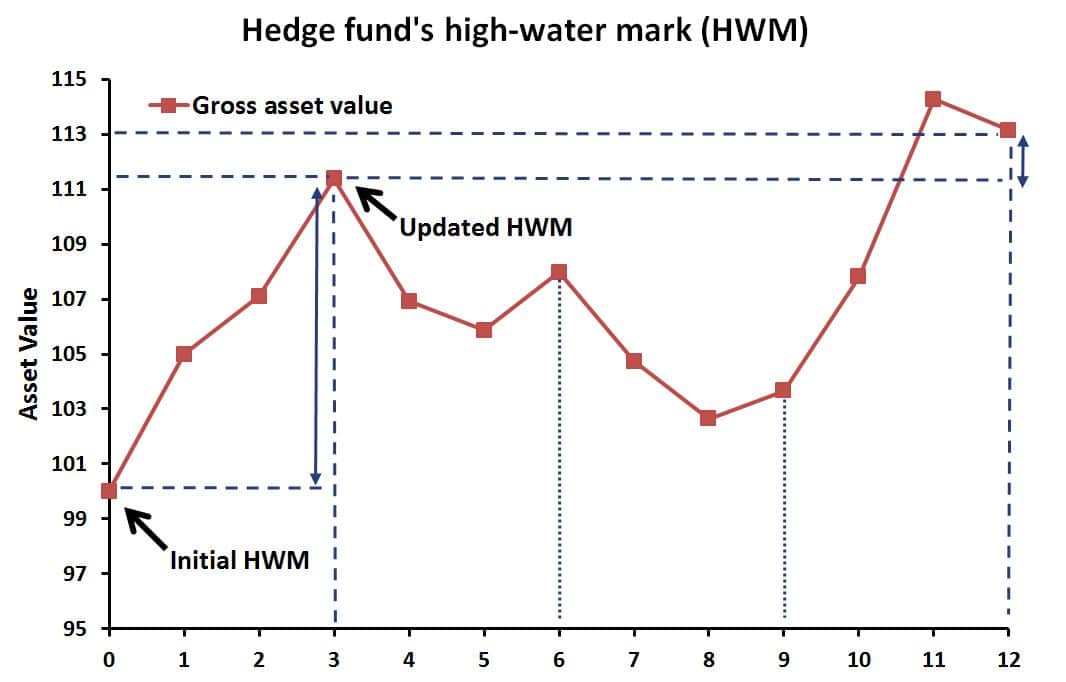

It represents the biggest value reached by. A set high-water mark guarantees that the investor is relieved from the obligation of paying performance fee for any future gains from 960000 to 12 million. In other words the standard will ensure that managers do not. We provide a closed-form solution to the cost of the high-water mark contract under certain conditions. The managers remuneration equals 20 of the increase in the share value or Once the performance fee is charged to the investors account we update the high-water mark to updated HWM. Dieser Spitzenwert ist nun die High Water Mark.

The highwater mark provisions in these contracts limit the value of the performance fees.

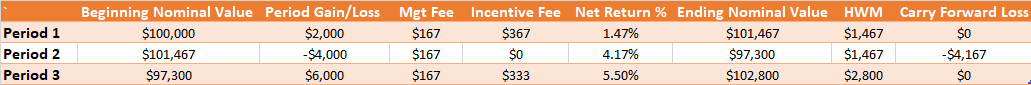

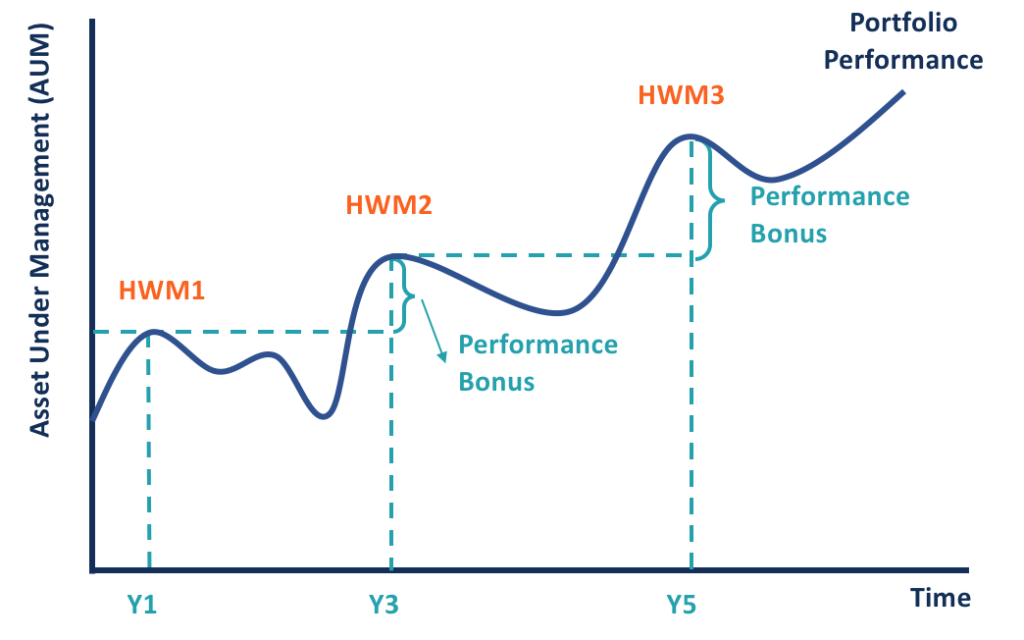

INGERSOLL JR and STEPHEN A. ROSS ABSTRACT Incentive fees for money managers are frequently accompanied by high-water mark provisions that condition the payment of the performance fee upon exceeding the previously achieved maximum share value. High watermark is the highest value of the fund in a financial year. The high-water mark in hedge funds shows the peak value that the funds achieve since their initial establishment. What is high watermark for hedge funds. A set high-water mark guarantees that the investor is relieved from the obligation of paying performance fee for any future gains from 960000 to 12 million.

Source: prepnuggets.com

Source: prepnuggets.com

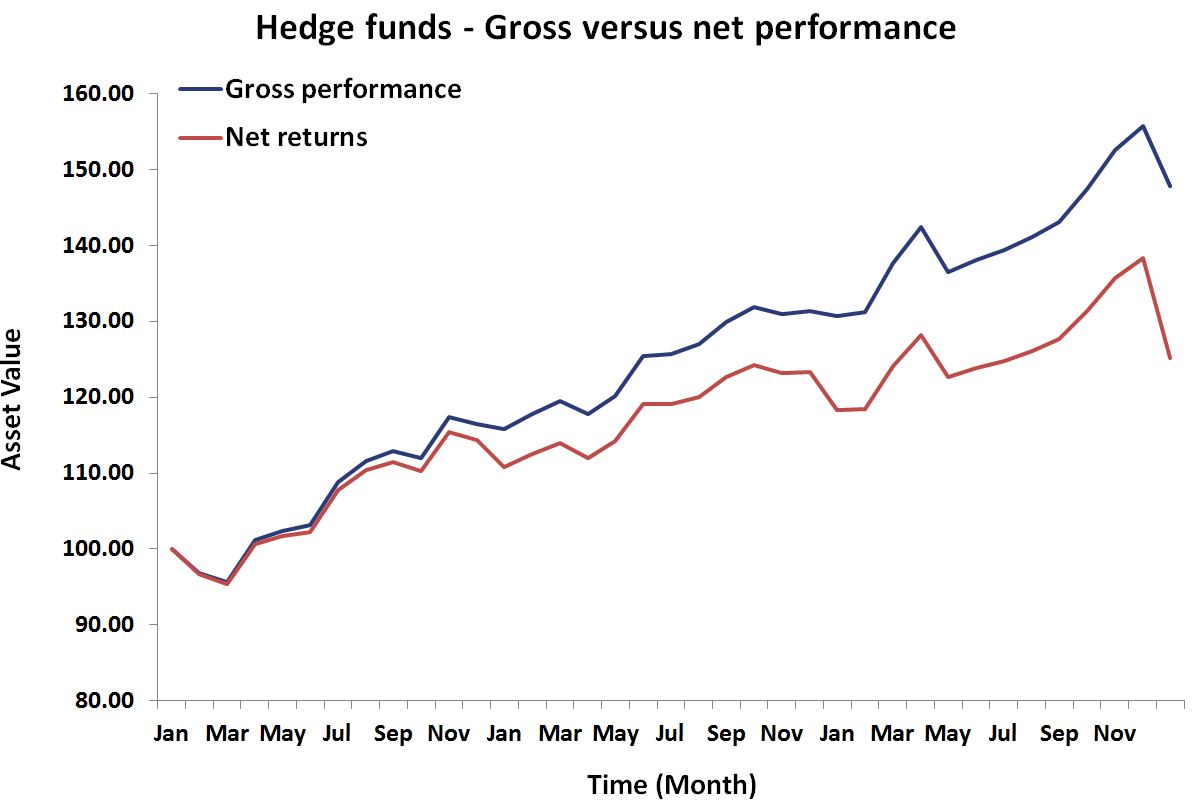

Hedge fund fees are usually two-fold. The high-water mark in hedge funds shows the peak value that the funds achieve since their initial establishment. High Water Mark. In other words the standard will ensure that managers do not. An industry standard that is used to determine payment of performance fees to a hedge fund s management.

Source: investopedia.com

Source: investopedia.com

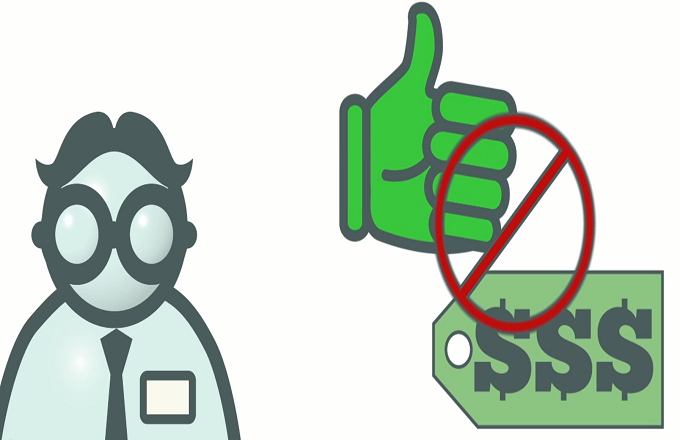

Hedge Fund Crystallization Frequency It is the frequency of fees is calculate and paid to the hedge fund firm. Hedge Fund Crystallization Frequency It is the frequency of fees is calculate and paid to the hedge fund firm. The highwater mark provisions in these contracts limit the value of the performance fees. Entitlement to the performance fee is contingent on recouping all losses incurred by investors. The high-water markHWM is an industry standard that is used to determine payment of performance fees to a hedge funds management.

Source: blog.fintelligents.com

Source: blog.fintelligents.com

The highwater mark provisions in these contracts limit the value of the performance fees. Our results provide a framework for valuation of a hedge fund management company. Entitlement to the performance fee is contingent on recouping all losses incurred by investors. However it can also work as a protection for investors. Hedge fund NAV 010104 1000000 Hedge fund NAV 123104 1200000 total after expenses including the management fee expense Gain 200000 Less Performance fee 40000 20 of 200000 Cumulative loss account 0.

Source: blog.fintelligents.com

Source: blog.fintelligents.com

High Water Marks in Hedge Fund Management Contracts Zur Erlangung des akademischen Grades eines Doktors der Wirtschaftswissenschaften Dr. In other words the. It helps limit excessive profit taking by the management. Hedge funds use the high-water mark as a measure for incentives for fund managers. The profit sharing will be based on this.

Source: youtube.com

Source: youtube.com

Hedge Fund Crystallization Frequency It is the frequency of fees is calculate and paid to the hedge fund firm. In other words the. The high-water mark in hedge funds shows the peak value that the funds achieve since their initial establishment. Assume that you invested 100k and in the first year it has reached up to 120k. The profit sharing will be based on this.

Source: software.tuncalik.com

Source: software.tuncalik.com

The highwater mark provisions in these contracts limit the value of the performance fees. Overall our results suggest that compensation contracts in hedge funds help alleviate inefficiencies created by. The highwater mark provisions in these contracts limit the value of the performance fees. ROSS ABSTRACT Incentive fees for money managers are frequently accompanied by high-water mark provisions that condition the payment of the performance fee upon exceeding the previously achieved maximum share value. Setting too high it will become a huge pressure for the fund manager to generate profit.

Source: managedfuturesinvesting.com

Source: managedfuturesinvesting.com

An industry standard that is used to determine payment of performance fees to a hedge fund s management. As mentioned hedge funds include both fixed and performance-based fees for managers. INGERSOLL JR and STEPHEN A. The high-water markHWM is an industry standard that is used to determine payment of performance fees to a hedge funds management. Assume that you invested 100k and in the first year it has reached up to 120k.

Source: investmentcache.com

Source: investmentcache.com

Margarita Sevostiyanova Tag der mundlic hen Prufung. What is high watermark for hedge funds. Dieser Spitzenwert ist nun die High Water Mark. The profit sharing will be based on this. The high-water mark provisions in these contracts limit the value of the performance fees.

Source: next-finance.net

Source: next-finance.net

A set high-water mark guarantees that the investor is relieved from the obligation of paying performance fee for any future gains from 960000 to 12 million. In jedem Jahr in dem der Wert des Fonds weniger als 125 Millionen US-Dollar beträgt erhält der Manager keine Performancegebühren. The highwater mark provisions in these contracts limit the value of the performance fees. ROSS ABSTRACT Incentive fees for money managers are frequently accompanied by high-water mark provisions that condition the payment of the performance fee upon exceeding the previously achieved maximum share value. The investor only has to pay performance fee for any subsequent gains that the fund attains after achieving the high-water mark amountFinally let us say in the third month the fund gains 40.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

ROSS ABSTRACT Incentive fees for money managers are frequently accompanied by high-water mark provisions that condition the payment of the performance fee upon exceeding the previously achieved maximum share value. The highwater mark provisions in these contracts limit the value of the performance fees. As mentioned hedge funds include both fixed and performance-based fees for managers. What is high watermark for hedge funds. We provide a closed-form solution to the cost of the high-water mark contract under certain conditions.

Source: blog.fintelligents.com

Source: blog.fintelligents.com

In this paper we show that hedge fund performance fees are valuable to money managers and conversely represent a claim on a significant proportion of investor wealth. As mentioned hedge funds include both fixed and performance-based fees for managers. A high-water mark represents the highest peak that investments have reached in value. The high-water mark in hedge funds shows the peak value that the funds achieve since their initial establishment. An industry standard that is used to determine payment of performance fees to a hedge fund s management.

Source: prepnuggets.com

Source: prepnuggets.com

Entitlement to the performance fee is contingent on recouping all lossed incurred by investors. Setting too high it will become a huge pressure for the fund manager to generate profit. Hedge funds use the high-water mark as a measure for incentives for fund managers. However it can also work as a protection for investors. In jedem Jahr in dem der Wert des Fonds weniger als 125 Millionen US-Dollar beträgt erhält der Manager keine Performancegebühren.

Source: breakingdownfinance.com

Source: breakingdownfinance.com

The managers remuneration equals 20 of the increase in the share value or Once the performance fee is charged to the investors account we update the high-water mark to updated HWM. The high-water mark in hedge funds shows the peak value that the funds achieve since their initial establishment. It helps limit excessive profit taking by the management. It represents the biggest value reached by. A high-water mark fee structure refers to the practice of charging incentive fees only on returns above the historical.

Source: breakingdownfinance.com

Source: breakingdownfinance.com

Assume that you invested 100k and in the first year it has reached up to 120k. At this point the high-water mark for this particular investor is 575000 and the investor is obligated to pay 15000 to the portfolio manager. Margarita Sevostiyanova Tag der mundlic hen Prufung. ROSS ABSTRACT Incentive fees for money managers are frequently accompanied by high-water mark provisions that condition the payment of the performance fee upon exceeding the previously achieved maximum share value. It helps limit excessive profit taking by the management.

Source: software.tuncalik.com

Source: software.tuncalik.com

In other words the. However it can also work as a protection for investors. Entitlement to the performance fee is contingent on recouping all lossed incurred by investors. Hedge funds use the high-water mark as a measure for incentives for fund managers. INGERSOLL JR and STEPHEN A.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title high water mark hedge fund by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.